Internet banking is the system that provides the facility to the customers to conduct the financial and non-financial transactions from their net banking account. The user can transfer funds from his/her account to other accounts of the same bank/different banks using Internet Banking Portal without any additional charges/fees.

The customer using this facility can conduct transactional and non-transactional tasks including:

⦁ View / download account statements.

⦁ View Account Summary.

⦁ Check the history of the transactions for a given period by the concerned bank.

⦁ Transfer funds via NEFT / RTGS / IMPS.

⦁ Quick Fund transfer upto 10,000/day.

⦁ Cheque related functions like Order Cheque Books, stop / revoke cheque, Deposit Cheque Status, Stop/remove cheque status etc.

VDC Bank’s WhatsApp Banking services have been launched to address all your Banking queries. Simply scan the QR using your mobile and avail the services offered by us. WhatsApp Banking is available in English and Gujarati language.

⦁ You will be prompted to send “Hi” from your WhatsApp Number to +917069033220 and follow the instructions given by the Chat-Bot.

Features

⦁ Balance Inquire.

⦁ Mini statement (up to 5 transactions).

⦁ Account statement (PDF).

⦁ Nearest ATM/Branch locator.

⦁ Loan products Features and Interest rates.

⦁ Deposit products Features and Interest rates.

⦁ Digital Banking information..

⦁ Contacts/Grievance redressal helplines.

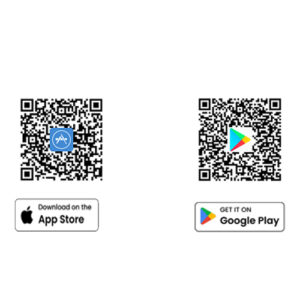

Mobile banking is just the facility you need when you are on the move. In the absence of a laptop/computer, your VDC Bank mobile app is the answer to all your banking needs. Be it a bill payment, phone recharge or a fund transfer, a mobile app takes care of all your basic banking needs. Our mobile banking gives you the freedom to bank irrespective of the place or time. While commuting or waiting at the airport, your mobile app is always ON!

The customer using this facility can conduct financial or non- financial transactions.

Features

⦁ Mobile Banking at your fingertips (Biometric login).

⦁ User can also login Mobile Banking by using their INB credentials.

⦁ View / download account statements.

⦁ View Account summary.

⦁ Check the history of the transactions for a given period by the concerned bank.

⦁ Transfer funds via NEFT / RTGS / IMPS.

⦁ Quick Fund transfer upto 10,000/day.

⦁ Cheque related functions like Order Cheque Books, stop / revoke payment etc.

⦁ Pay any kind of bill, recharge mobiles, DTH connections, etc.

⦁ Standing Instructions Creation.

⦁ Minimum Two factor authentication.

⦁ ATM Green PIN generation.

⦁ Activation/deactivation and Transaction limit customization for ATM/POS/ECOM.

⦁ Spend Analyzer.

© 2023 Valsad District Central Co. Op. Bank Ltd